Talon Metals

A Deep Dive Into The Next Energy Metals Unicorn

On May 12th of this year, Talon Metals astonished the mining community with what may be one of the most significant magmatic nickel-copper-cobalt PGE discoveries on record. Assays confirmed 58% copper equivalent over 34.9 meters. To help contextualize this result for those familiar with porphyry copper deposits, the assay is roughly equivalent (in total copper content) to finding 2 kilometers of 1% copper or 1 kilometer of 2% copper. These are extraordinary values by industry standards. According to the USGS, if Talon’s drill hole grade were hypothetically stretched to a kilometer length, it would place in the top 1-3 all-time porphyry copper intercepts worldwide, possibly even #1 for length at such a high grade, rivaling discoveries like Cascabel in Ecuador or Oyu Tolgoi in Mongolia.

Tamarack’s Vault zone has set a new standard, placing the discovery in a league of its own. On the global stage, the only comparable analog is Noril’sk, Russia, currently a 100-year operating mine and a $340 billion valuation in 2021 prior to the Ukrainian conflict.

The core from hole 563 revealed Talon drilled into a zone of pooled sulphides of exceptional abundance, described as a concentrated blob of pure metal, truly a remarkable find. This style of massive sulphide pooling, also observed at Noril’sk, highlights the similarities in ore genesis between Tamarack and the global giant. Upon initial examination of the core, Chief Exploration Geologist Brian Goldner remarked, “I thought it was fake.” Such was the exceptional quality of the discovery.

“Drill hole 25TK0563 intersected a combined length of 34.90 meters across two zones of MSU starting at 762.34 meters grading 14.86% Ni, 15.37% Cu, 0.11% Co, 9.18 g/t Au, 16.31 g/t Pt, 8.65 g/t Pd, and 42.92 g/t Ag.”

Drill hole 25TK0563 — A Pooled Zone of Pure Metal

So, just how good is Talon’s discovery?

Vault Zone…

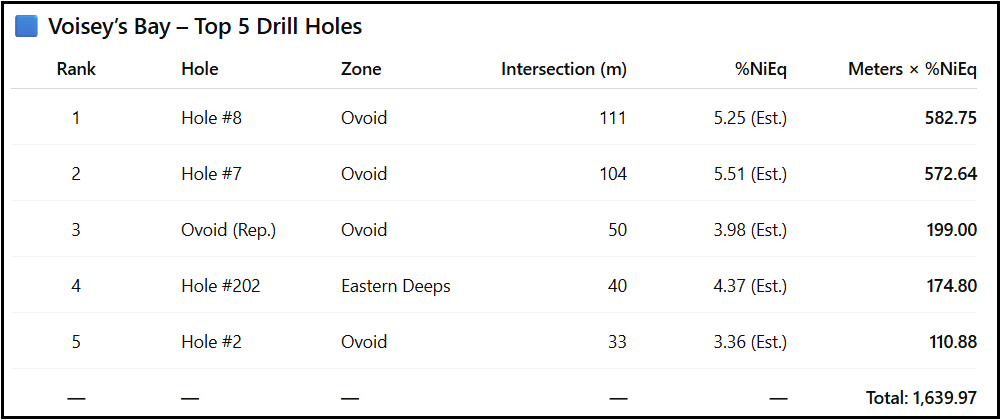

Let’s compare the top 5 best holes of the Voisey’s Bay deposit, a world-class magmatic nickel ore body in Labrador, Canada, versus Talon’s Tamarack deposit in Minnesota.

The following table shows Voisey’s Bay with a combined 1,637 meters x %NiEq compared to Tamarack’s 1787 meters x %NiEq. Tamarack the clear winner, showcasing the remarkably high-grade nature of the mineralized system that formed within the Mid-Continental—Keweenawan Rift. The Vault zone discovery is still in its early stages, yet the deposit has already surpassed Voisey’s Bay’s top holes, a sign of a system with much more in the tank to give. Talon’s drill intercepts highlight the extraordinary sulphide enrichment of the primitive magmas associated with early rifting events in the region.

Highly productive magmatic ore bodies form through successive generations of sulphide-rich magma pulses that undergo fractionation. The process produces immiscible sulphide droplets, which subsequently aggregate and accumulate (pool) within conduits and sedimentary horizons as a result of gravity-driven processes known as water-falling. Age dating studies indicate Russia’s Noril’sk deposit formed over one million years, whereas the same studies at Tamarack show ore formation occurred over twice that, nearly two million years. The findings suggest that Tamarack is sitting atop a giant, long-lived, primitive magmatic system and has barely begun to uncover the potential scale of this mineralized system at depth.

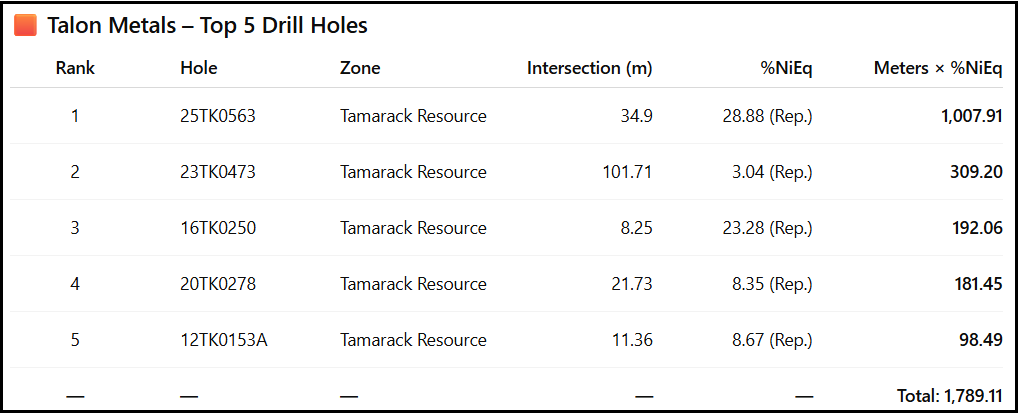

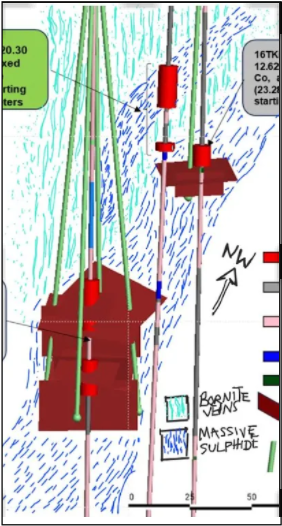

To put Tamarack’s potential into perspective, Talon drilled three consecutive holes (250, 563, 565) into the Vault zone, all hitting massive sulphides, back to back, to back, not only confirming Talon’s in-house BHEM-generated targets are 100% legit, but they’re literally seeing these units of massive sulphides in each anomalous plate, in other words the use of BHEM is highly predictive.

Hole 250 - 8.25 meters of 12.62% Ni, 13.88% Cu, 0.12% Co, and 17.95 g/t PGEs +Au.

Hole 563 - 68-meter step out from hole 250, hitting 34.9 meters of 58% copper equivalent, a slightly higher grade metal tenor encountered in hole 250, suggesting grade is increasing with depth.

Hole 565 with a 26-meter step out north-west of hole 250 returned 20.3 meters of the same semi-massive and massive sulphides.

Here’s the kicker: Drill holes 250 and 563 reported encountering distinct 100 meter zones of 2-10% semi-massive disseminated sulphides (chalcocite and bornite) in veining structures above each of their respective high-grade intercepts. Notably, the same semi-massive mineralization was also encountered above the high-grade mineralization in hole 565. All three holes proved a thick envelope of semi-massive chalcocite-bornite occurs within vein structures and disseminations draped above what appears to be multiple stacked horizons of pooled massive sulphides.

Today’s press release (November 04, 2025) confirms the hypothesis of a broad zone of semi-massive sulphides draped over a series of stratigraphically controlled stacked accumulations of massive sulphides producing what can only be described as a world-class result—390 meters of 3.23% nickel or 6.14% copper equivalent. A further extension of drill hole 16TK0248 shows an extensive sub-vertical low conductivity anomaly exits below the main Vault discovery, within the (coarse grained olivine) intrusive body. This connective pathway produced a repetitive process of sulphide accumulation and lateral extension within sedimentary horizons that may repeat for more than 300 meters below the deepest known intercepts in the Vault Zone. As per Talon’s VP of Geophysics, the initial borehole electromagnetic (BHEM) results appear analogous to the geometry of the Reid Brook Zone at Voisey’s Bay.

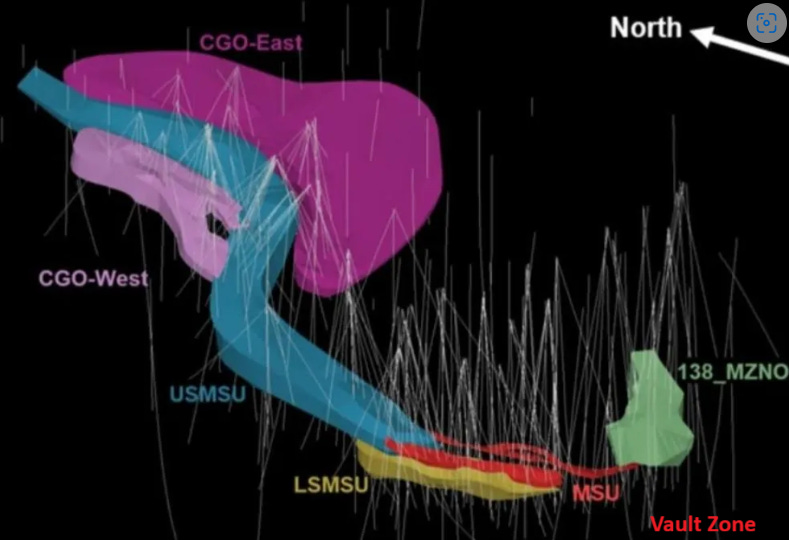

Historically, at Tamarack, massive sulphide mineralization typically forms laterally continuous accumulations on either side of the magmatic intrusion, forming distinct limbs. The Vault Zone displays multiple accumulations of massive sulphides on the south side of the intrusion. The potential exists for massive sulphide stacks to occur on the opposite north side, an area with no prior drilling, where the intrusion makes contact with the same horizontal sedimentary horizons—see the right side of the conceptual cross section below, drawn in blue.

“When combined with the previously reported 34.9 meters of massive sulphide mineralization grading 28.88% NiEq (57.76% CuEq), the drill hole returned a total of 390.17 meters grading 3.23% NiEq (6.14% CuEq) -the highest nickel-equivalent grade multiplied by length interval ever recorded at the Tamarack Nickel-Copper Project.”

Vault Zone - Hypothetical Gravity Driven Pooling and Vein Envelope Model

Talon smoked the best nickel deposits in the world with the Vault discovery, prompting the exploration team to re-run the BHEM and MT geophysics with an E-W trend orientation, and lo and behold, this approach revealed a completely new perspective of the system previously unknown. The plates at the bottom of hole 563 indicated stacked anomalous EM zones lighting up in all directions—north, south, east, and west, suggesting the pooled massive sulphides carry over some distance.

The company’s proprietary BHEM geophysics confirmed that the waterfall model with gravity-driven sulphides draining vertically, becoming trapped in stacked sedimentary horizons, is fully in play. Given copper zonation is known to increase as fractionation of the melt matures over time, it’s not surprising to see the nickel-copper grade increase deeper in the system as the drilling encounters additional pooled mineralization. An analysis of holes 250 and 563 reveals a notable 1-2% nickel-copper grade increase in drill hole 563, oriented approximately 68 meters laterally and deeper than hole 250, thus suggesting that the grade is increasing with depth.

Raptor Zone…

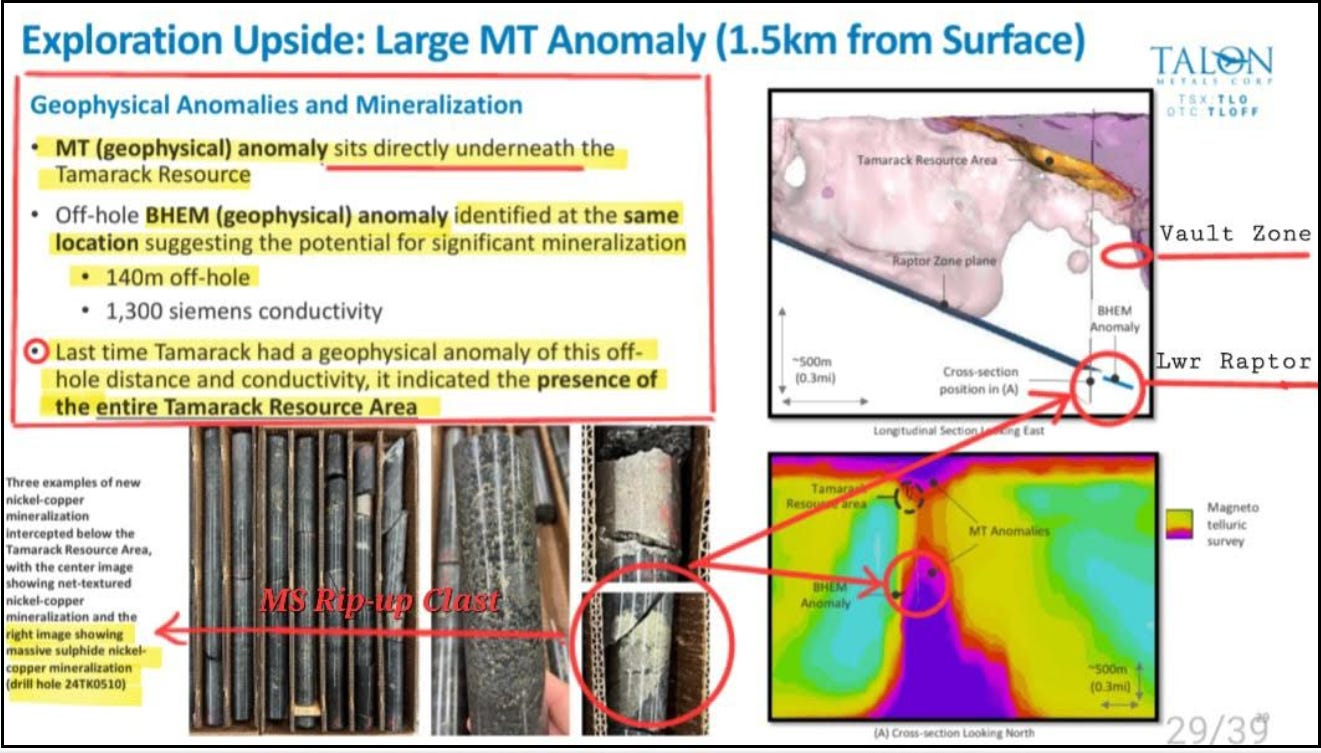

In 2024 Talon drilled into the Lower Raptor Zone intersecting several massive sulphide clasts in drill hole 24TK0510 indicating the hole was not far off it’s intended target. The clasts are interpreted as fragments plucked from the mineralized source wall rock and transported by ascending magmas within the plumbing of the magmatic conduit system.

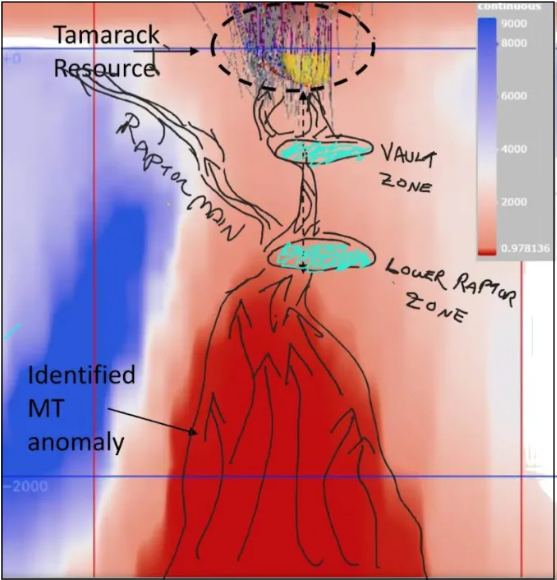

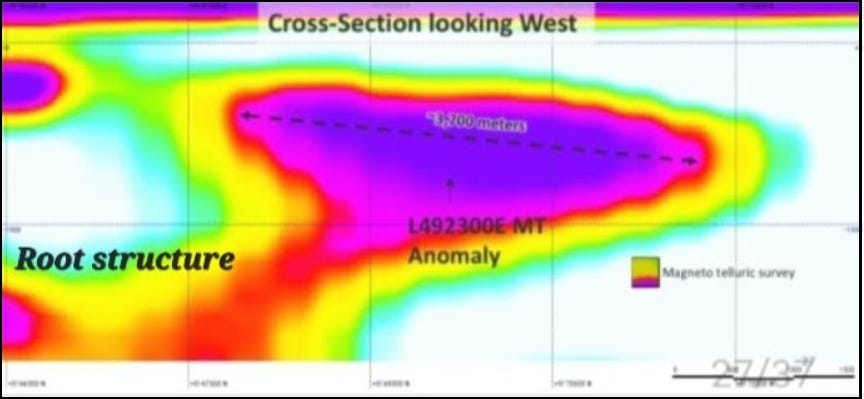

Subsequent borehole electromagnetic (BHEM) geophysical surveys identified a very strong EM anomaly registering 1300 siemens of conductivity sitting nearly directly underneath the Vault Zone discovery at depth. These results suggest the drill hole missed hitting a highly conductive body estimated to be 140 meters away. A later magnetotelluric (MT) survey confirmed the BHEM anomaly by detecting a coincident kilometer scale conductivity zone with a distinct conduit-feeder structure at its base—potentially the guts of the entire magmatic complex.

“This MT anomaly begins at a depth of approx. 1000 meters and extends to approx. 1500 meters, with a strike length of approx. 3700 meters”

Brian Goldner in interview remarked, “There are no dumb questions,” when trying to unpack the geological events that led to the mineralization at Tamarack. One potential hypothesis I’ve contemplated is that we’re looking at the remnants of a second magmatic pulse undergoing thermal erosion, “plucking” existing mineralization from an earlier ore-forming event at depth, and later transporting the clasts higher up or laterally along a magmatic conduit feeder structure.

I note, the appearance of rounded edges, and the semi-elongated shape of the highlighted clast suggesting thermal erosion/partial melting resulting in net quenching of the magma (a remobilizing of the nickel sulphides) where the core shows a net texture nickel-copper mineralization.

Slide 29 (pictured two images above) possibly the most important slide of the corporate presentation reveals the significance of hole 24TK0510 and the coincident BHEM and MT anomalies deep into the heart of the system. In this slide Talon states the “last time Tamarack had a geophysical anomaly of this off-hole distance and conductivity, it indicated the presence of the entire Tamarack Resource Area.”

Vault and Lower Raptor Zone - Conceptualized Plumbing Model

If the BHEM and MT anomalies in the Lower Raptor Zone are confirmed as a deeply rooted zone of structurally controlled massive sulphides, the Noril’sk analog of a giant magmatic nickel system would undoubtedly be validated, and the Tamarack deposit would be in line to become one of the most important polymetallic ore bodies on the planet.

The Value proposition

The uniqueness of Tamarack’s Vault Zone discovery lies in the minimal volumetric area a pooled zone of massive sulphide rock can deliver in terms of value creation. Step out drilling of the Vault Zone - confirming that even a small block of rock has the potential to rapidly drive Talon’s market capitalization significantly beyond $1 billion USD very quickly.

For illustration, let’s perform a quick and dirty calculation to estimate what the value of a 60-cubic-meter block of 58% copper equivalent ore might be valued at.

Dimensions: 60m × 60m × 60m = 216,000 cubic meters.

Assume ore density: 3.2 tonnes per cubic meter (typical density for nickel ore at Eagle Mine in Michigan)

Total mass = 216,000m³ × 3.2 tonnes/m³ = 691,200 tonnes.

Copper mass = 691,200 tonnes × 0.58 = 400,896 tonnes of copper.

Copper spot price: $5.00 per pound.

Value of copper = 400,896 tonnes × $11023.10/tonne = $4,419, 076, 608 USD

A 60m × 60m × 60m cube of 58% copper equivalent ore is worth approximately $4.42 billion USD, or $6.14 billion CDN.

Shifting gears…

The Political Climate is primed for a Perfect Storm in the Critical Minerals Sector.

Even with the recently announced 1 year trade truce it’s clear the gloves have come off between the US and China over critical minerals. China’s recent decision to halt rare earth exports, a critical move in the escalating trade war with the United States, threatens to severely disrupt global supply chains and ignite economic uncertainty across key industries. The United States has been busy making substantial financial investments (billions of dollars) to secure equity positions in companies such as MP Materials, Lithium Americas, and Trilogy Metals to mitigate strategic risks in the supply chain. These initiatives aim to develop an integrated domestic supply for critical resources like lithium, nickel, cobalt, and copper and other metals vital to the nation’s energy infrastructure and national security. This strategy positions Talon with its Tamarack deposit in the cross-hairs of the US administration’s efforts, setting the stage for a potentially bigger deal with U.S. equity involvement.

What’s at stake? The United States imported approximately $10 billion worth of Chinese battery materials in 2024, with a significant portion consisting of EV battery cathodes. This development intensifies the ongoing US technology conflict, following the implementation of US tariffs on Chinese EVs earlier in 2024. While this may expedite US initiatives to localize production, achieving independence could take years due to China’s dominant market share.

Lithium Americas holds a 62% stake in the Thacker Pass lithium project, a joint venture with General Motors (38% stake). On September 25, 2025, the U.S. Department of Energy acquired a separate 10% stake in the joint venture as part of a restructured $2.26 billion loan agreement. After the US buy-in deal was announced LAC did a 339% re-rate. Similar moves were made by MP Materials and Trilogy Metals.

So why does this matter?

The similarities between Lithium Americas and Talon Metals are striking. Both companies are advancing world-class ore bodies, and both companies are engaged in 60/40 joint venture partnerships with prominent industry leaders: Lithium Americas with General Motors, and Talon Metals with Rio Tinto. The US needs to secure domestic nickel and cobalt feedstock, and Talon is aggressively advancing its role in the US critical minerals supply chain, particularly through its high-grade Tamarack nickel-copper-cobalt project in Minnesota and the associated Battery Minerals Processing Facility (BMPF) in North Dakota.

Talon’s vertically integrated push—emphasizing end-to-end domestic production of refined nickel for EV batteries and defense applications—has been bolstered by targeted federal funding. This aligns with the Trump administration’s 2025 strategy to onshore critical minerals via the Defense Production Act (DPA), Bipartisan Infrastructure Law (BIL), and direct investments, reducing reliance on China (which controls ~70% of global nickel processing).

As of Nov 04, 2025, Talon has secured $137.9 million in total US government funding, focused on extraction innovation, processing infrastructure, and exploration. This includes grants and contracts from the Department of Energy (DOE) and the Department of Defense (DOD). This funding has accelerated Talon’s feasibility studies and environmental reviews. Talon holds a 51% JV stake with Rio Tinto (option to increase to 60%), with plans to enable advanced metallurgical tech like Bipolar Membrane Electrodialysis for acid recycling. The BMPF will produce battery-grade nickel concentrate, supporting US energy independence amid future trade tensions abroad (i.e., Indonesia’s raw nickel export curbs).

Talon’s grants reflect a broader 2025 US policy shift toward equity stakes and direct investments in critical minerals firms, as seen with peers, MP Minerals, Lithium Americas, and Trilogy Metals. This “share the risk” model—invoked via the Defense Production Act and executive orders—has de-risked projects while prioritizing domestic supply chains.

Talon has an Offtake agreement with Tesla Motors locked in for 75,000 tonnes of nickel-in-concentrate over 6 years starting ~2028, thereby aligning with US EV goals. The production timeline for underground mine permitting is underway, with the first output of ~1.3 Mtpa ore targeted in 2028. This positions Tamarack as a “go-to” for US nickel independence, in line with DOE/DOD priorities under the Bipartisan Infrastructure Law and Defense Production Act.

Trump Administration—Orion Resource—Abu Dhabi Sovereign Wealth Fund

On Oct 23, 2025—The U.S. and Abu Dhabi governments will invest $1.8 billion into mining and refining projects across the globe with private equity fund Orion Resource Partners to bolster Western access to lithium, rare earths and other critical minerals. The proposed partnership underscores Washington’s efforts to challenge China’s dominance in critical metals and rare earth elements. According to sources familiar with discussions, parties would contribute equal amounts to achieve a combined total of $5 billion over time.

Orion, Sweetwater Royalties, UPX, and Talon Metals Connection

In 2020, Orion established Sweetwater Royalties as a private industrial minerals royalty company to oversee a vast portfolio of mineral estates, including over 4.5 million acres across Wyoming, Utah, Colorado, and Michigan, generating stable cash flows from royalties (over $280 million to date) in industrial minerals, base metals, and renewables. Sweetwater’s Michigan holdings encompass approximately 450,000 acres in the Upper Peninsula near the Eagle Mine, a premier nickel district.

UPX Minerals Inc. serves as a wholly-owned subsidiary of Sweetwater, holding and managing these Michigan mineral rights, which were originally acquired from Rio Tinto’s Kennecott Exploration in 2013. In August 2022, Talon Metals entered into an Option Agreement with UPX, granting Talon the right to earn up to an 80% ownership interest in UPX’s ~400,000-acre Michigan nickel properties package through staged exploration commitments, including $3.5 million CAD in spending and 25,000 meters of drilling by August 2027 to secure 51% with a further option for 80% via a feasibility study. This structure positions Orion, via its majority stake in Sweetwater, as an indirect strategic partner in Talon’s Michigan expansion.

The Orion linkage provides Talon with a strong institutional foundation, enhancing its credibility and access to capital as it pursues significant discoveries in Michigan’s Upper Peninsula. The company has reported its first intercept at Boulderdash, achieving 99.92 meters at 1.60% CuEq from shallow depths, followed by an additional 110.3 meters at 2.24% CuEq. Talon is already making progress toward the stage one earn-in, having drilled 14,000 meters as of October 2025. Orion’s deep expertise in metals royalties, along with its successful track record of monetizing assets through sales to blue-chip investors, indicates strong confidence in the value of the Michigan package. This may lead to opportunities for co-investment, joint ventures, or mergers and acquisitions, especially as Talon integrates these assets with its flagship Tamarack project in Minnesota.

Talon Metals: Positioned for a Major Re-Rating

Talon Metals is on the verge of a significant re-rating driven by exploration successes that underscore its position as a premier U.S. domestic nickel explorer and supplier. The company’s flagship Tamarack project in Minnesota has delivered unprecedented grades through the Vault Zone discovery—the most important nickel find in US history, and located just 150 meters below the existing resource. An expanded fall-winter 2025-2026 drilling program, utilizing 3 rigs will deliver the necessary drill power to really pour the coals to this thing and reveal what’s sitting below the 138 Zone.

In addition, Talon’s portfolio in Michigan’s Upper Peninsula, covering 400,000 acres under the 2022 UPX Minerals option agreement, has led to the Boulderdash discovery. Notable intercepts include 110.3 meters at 2.24% CuEq (0.88% NiEq), starting from a depth of only 9.54 meters, with massive sulfides extending down to 190 meters. This site is located just 8 miles from Lundin Mining’s Eagle Mine, whose reserves are anticipated to deplete by 2027-2029.

This positions Talon as the natural successor in America’s only operational nickel-copper-cobalt district, poised to replicate Eagle’s successful economic model amid ever-growing supply challenges. Talon stands out as the only game in town for domestic nickel supply in the U.S., including battery-grade nickel oxide concentrate, which sells at a 30% premium to the spot price. This nickel premium alone will push the NAV and IRR to values the market has yet to figure out. With its rich endowment of copper, cobalt, gold, silver, and platinum-group elements (PGEs)—the Tamarack project is destined to become a money printing machine for decades, possibly generations, if the mineralized structure is validated deep in the system where the BHEM and MT show a large conductive body exists.

Today’s press release—390 meters of 3.23% nickel / 6.14% copper equivalent undeniably confirms Talon just drilled into a world-class ore body that analogs with Voisey’s Bay Reid Brook Zone, per Talon’s geophysicist. The updated model shows a large sub-vertical, structurally controlled conductive body extending 300 meters beyond the current 390 meters of known mineralization. This suggests a vertically extensive mineralized zone, potentially 700 meters in length, forming along the CGO intrusive contact where massive sulphide “blow-out” structures systematically occur within sulphur-rich sedimentary horizons. The highly enriched geochemical characteristics of the primitive magma at Tamarack imply that the opposite side of the intrusion may have experienced similar conditions, potentially resulting in a second broad mineralized zone along its contact—historically consistent with massive sulphide zones found higher up in the system. I expect a massive re-rate when the market wakes up to what Talon is sitting on, a multi-billion dollar discovery. Giants do sleep...

Thanks for reading Whalehunter’s Substack! Subscribe for free to receive new posts and support my work.

DISCLAIMER: The content included in this [article/post] is based on current events, technical data, company news releases, corporate presentations, and the author’s personal opinions and interpretations as of 10:12 AM PDT on Tuesday, November 04, 2025. It may contain inaccuracies or errors, and you should not make any investment or financial decision based on the information provided here. This publication includes forward-looking statements, such as predictions, projections, and analyses, which are subject to risks and uncertainties that could cause actual results to differ materially. The author/publisher assume no liability for any losses or damages arising from the use of this content, and it is your responsibility to conduct thorough due diligence before taking any investment action. This material is for informational purposes only and does not constitute financial advice, solicitation, or a recommendation to buy or sell any security or promote investment products. Re-transmission of this content is prohibited.

The stock(s) discussed in this publication are high-risk venture stocks and not suitable for most investors. Consult Company SEDAR profiles for important risk disclosures. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Mineral resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility. It is your responsibility to conduct thorough due diligence, contact management and verify.

The author owns Talon Metals shares at the time of this publication and may buy or sell at anytime without notice.

Thanks! I much appreciate the feed back, my first attempt at Substack, happy my efforts were well received. I couldn't agree more, Tamarack has all the hallmarks of a strategic asset.

Great Job! I'm heavily invested in this one. Numerous trips out there this year. Just insane grades! If they can further define this area it is quite possible they could pull enough ore at that grade to make $6 to $10 billion in a year! Let that sink in verses present market cap.